Founded in 1997 in response to the Exxon Valdez oil spill (then the biggest oil spill the United States had ever seen), the Global Reporting Initiative (GRI) aimed to create a standard for environmental accounting and reporting and to measure corporate adherence to responsible ecological conduct. It released its first standards in 2000, and over 10,000 companies worldwide produce GRI reports. An increasingly sophisticated network of regional offices, sector standards, and industry support programs means the GRI framework is now broadly accepted as the world’s voluntary sustainability reporting standard.

Many of the subscribing clients of Benchmark Gensuite Partners use GRI reporting. We are a Certified Software Partner, and the GRI Standard is licensed and embedded in our ESG Director module. However, two significant developments are emerging this year concerning GRI reporting that require close attention; the release of the 2021 Standard and the emergence of the European Corporate Sustainability Reporting Directive (CSRD).

The GRI 2021 Reporting standard updates the (current) 2016 standard. As of the first of the year, all GRI reporting companies will need to use the 2021 standard to be accredited GRI reporters. A subsequent blog post will examine how this can be managed in the Benchmark ESG platform. For now, let’s focus on the emergence of the CSRD and what it means for GRI reporters.

CSRD Alignment

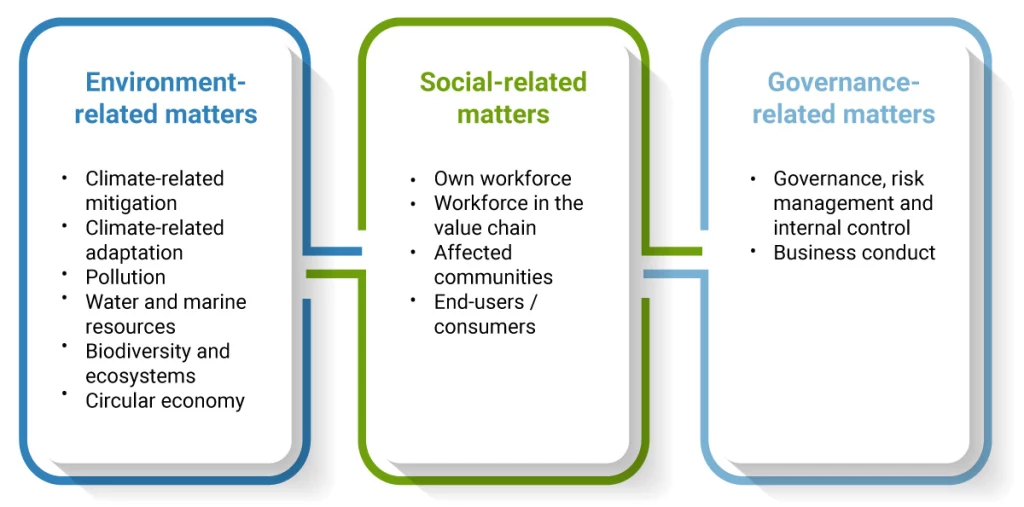

The European Union has implemented the CSRD to provide a consistent and standardised framework for corporate operations to report their Environmental, Social, and Governance (ESG) performance. It is implemented using the European Sustainability Reporting Standard (ESRS). This sets out the disclosure topics for the three themes; see Figure 1 below.

The ESRS was released in August for a 100-day public comment period, and about 1000 responses were received from industry associations, NGOs, trade unions, financial corporations, professional services firms, and academics. The response was broadly supportive, with a consensus agreeing to the need for a standardised set of European sustainability reporting guidelines. There was a significant concern, however, about the practicality and burden of some aspects of the proposed standards, including:

- The sheer number of data points to be collected (over 2000) and the granularity required which was seen as placing an overly onerous burden on business

- The requirement to collect data from the value chain was seen as being difficult/unrealistic, with the ability to audit especially being constrained

- The schedule for the phase-in of new reporting requirements was challenging

- Alignment with other standards was not always clear

- The overall complexity of the standards was seen as too high, even for sustainability professionals to use

As a result, the ESRS has been revised and transmitted to the European Commission for endorsement. Resulting from the initial comments on the draft ESRS, the following changes were made:

- The final proposal reflects a higher scope of materiality assessment, eliminating the burden of having to justify and explain the omission of specific information under the rebuttable presumption

- The reduction of Disclosure Requirements (136 to 84) and quantitative and qualitative data points (2,161 to 1,144). This reflects the decision to move some of the requirements to the future sector-specific standards and to eliminate other conditions, where the benefits in terms of information provided according to the CSRD requirements were assessed as not exceeding the corresponding preparation costs

- One of the initial 13 standards (ED ESRS G1) has been eliminated following the narrower focus on Governance in the CSRD text released in June 2022

- The approach to the value chain has been clarified and focused on the materiality of the value chain information

- A specific phase-in of three years has been included for the value chain information, also reflecting the corresponding provision in the CSRD

- For several disclosure requirements, a phase-in from one to three years has been introduced

Regarding the overall burden, the technical committee has concluded that “while the costs affect some specific categories of stakeholders, the scope of expected beneficiaries is much broader. In conclusion, EFRAG considers that the prices of this set of standards are likely not to exceed, in the longer run, the corresponding benefits, including those to society and the environment. “

They are expected to enter law by the end of 2022 without further public consultation.

GRI and ESRS Alignment

The GRI has worked with the ESRS Technical Committee to ensure alignment between the ESRS and its framework. As much as possible, they want to establish GRI reporters to leverage their existing reporting processes to meet ESRS requirements. This will help achieve global comparability and to limit additional or duplicated reporting requirements.

However, a critical difference between the two standards is that the GRI framework is based on impact-focused reporting (what impact does the operation have on the environment), while ESRS has a double materiality focus (which also considers the potential impact of environmental factors on business operations and risk). This will inevitably result in a lack of alignment in some areas, and reporting companies must consider both requirements carefully.

Challenges for companies

Companies reporting to GRI standards and meeting the criteria for mandated ESRS reporting will need to address both standards. The GRI organisation states that GRI reporting companies will be well-positioned to meet the requirements of the ESRS. This is as far as they can go, as it is clear there will be differences. Companies may also respond to other voluntary or mandatory requirements, such as CDP, TCFD, national regulations, investor ESG disclosure requests, subscriber requests, and internal management information needs.

Benchmark has developed a solution for this unprecedented data challenge with the ESG Director module, underpinned by our proprietary Data Exchange Portal. This allows an organisation to bring together accurate, timely, and relevant data from across the organisation to address material issues. Data collection from plants, sensors, meters, enterprise systems, point solutions, manual data input sources, and third parties can be managed in a streamlined, automated workflow. AI tools can be used for automated capture and accuracy verification. This provides the organisation with a single consolidated source of investment-grade data.

ESG Director provides the reporting and disclosure frameworks to automate reporting in accordance with selected standards and maps out the alignment between each. When the ESRS standard is released in 2023, this will also be embedded into ESG Director. It also feeds into a powerful analytics and dashboarding capability.

If you’re struggling with current sustainability and ESG reporting requirements or recognise the challenges approaching 2023 with increased reporting obligations, contact us to discuss ESG Director. The first movers in our subscriber base are deploying this solution across their organisations now, and we’d love to discuss how we could help you.